What Credit Score is Needed for a Car?

According to Equifax, the average Canadian has over $22,000 of debt, excluding mortgages. Depending on how this debt is managed, it can impact your credit score – either positively or negatively. What’s a credit score? A 2013 Globe and Mail article describes it as “…a number which essentially sums up all that information and tells lenders how much of a default risk you are, or, how profitable you can be for them.”

If you’ve been managing your debt by making payments on time, making more than the required payment and avoiding the accumulation of new debt, then your credit score is likely to improve. If your debt payments are irregular and you have accumulated additional debt, your credit score is likely going to decrease. Your credit score may have also decreased as a result of a recent bankruptcy or consumer proposal.

Most car buyers will search for car financing since according to The Globe and Mail, only about 17 percent of Canadians in the market for a new or used vehicle are able to make their purchase with cash. The big question is whether your credit score will allow you to secure a loan for the car of your choice. So what credit score do you really need to purchase your car?

What credit score do I need to get a car loan?

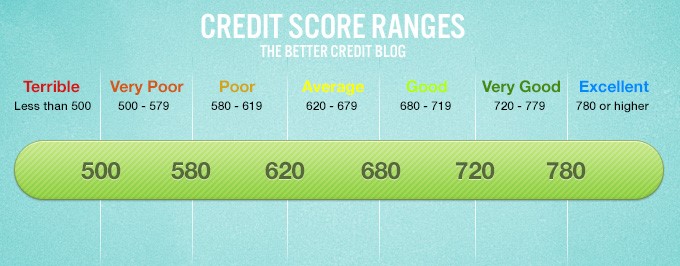

Let’s take a look at some typical credit score ranges:

Source: https://loanscanada.ca/wp-content/uploads/2013/03/credit-score-range.jpg

Credit scores range from 300 to 900, with 300 being the worst and 900 being the best possible score. Generally speaking, customers shopping for a vehicle who have a credit score anywhere from 670 to 900 are classified as prime and considered to be low risk. If your credit score falls in this category you should easily meet the credit score criteria for getting approved.

Will I be able to get a car loan with a bad credit score?

If your credit score is lower than 670, there is no need to panic- you can still get back on the road! A 2016 report from the Financial Consumer Agency of Canada noted that approximately 25 percent of all vehicle financing went to customers who were considered non-prime (including subprime and deep subprime), based on their credit score.

The table below from Bankrate.com shows the average interest rate by credit score for Americans who secured an auto loan at the end of 2016 (score classifications and interest rates may vary for Canadians):

Source: http://www.bankrate.com/financing/cars/what-credit-score-is-needed-to-buy-a-car/

As you can see, customers whose credit scores were lower (nonprime, subprime and deep subprime) were able to receive vehicle financing. Unsurprisingly, based on the level of risk involved, customers who have a credit score that is 660 or lower should be prepared to pay higher interest rates than their prime and super prime counterparts.

If my credit score is low, what can I do to improve my chances of getting a car loan?

Santander Consumer USA and ConsumerAffairs have compiled several tips that are helpful for Canadians with a credit score between 300 and 670. Below are some of our favourites:

- Check your credit score

Lenders will check your credit first and you don’t want to be surprised when they contact you with the results. Also, by knowing your credit score in advance, you can determine your classification (deep subprime to super prime) and start preparing your total monthly budget based on an estimate of your interest rate.

- Prepare for a new loan

Where possible, try to pay off or make payment arrangements for any outstanding bills that have been reported to a collections agency. Also try to make regular payments on your loans and bills, so you appear less risky to the car loan lender.

- Have the necessary records handy

Lenders will need certain information from you early in the loan application process such as, proof of income (two recent pay stubs), work history, proof of residence and records of on-time payments.

- Look at different options

Just because your credit score is lower, it does not mean that you have to accept the first offer for financing presented to you. It is important to shop around because you may find another lender that will offer you a better interest rate.

- Search over a two-week period

Credit inquiries performed by lenders are considered ‘hard’ inquiries and negatively impact your credit score. There is a silver lining here though – if you limit your vehicle search to a two-week period, the impact to your credit score will be reduced. The scoring models used by Equifax and TransUnion count all of the credit inquiries carried out by similar lenders (auto, mortgage, etc.) within a two-week period as one inquiry because they know you’re shopping around for the best rates.

- Select a newer model vehicle with low mileage

You may be tempted to select an older model vehicle with higher mileage because it seems like a cheaper option, but in reality, this may end up being more expensive. Lenders may apply a higher interest rate to an older vehicle with high mileage because it is less reliable than a newer vehicle. Lenders expect that you will have more repairs with an older vehicle, and that you may be forced to choose between car repairs and your car payment.

- Use the 20/4/10 rule

J.D. Power Canada’s Automotive Market Metrics for June 2017 showed that Canadians are paying on average, $600 per month for their car. In order to manage your car loan payments, experts suggest that you budget for a down payment of 20% of the value of the car. It is also recommended that you avoid financing the vehicle for longer than four years. Additionally, your monthly vehicle expenses (loan payment, insurance) should not exceed 10% of your monthly gross income.

When it comes to financing, lenders place a high value on credit scores. It is a key component of your ability to secure future credit, especially for your next vehicle. If your credit score is 670 or higher, you should be able to obtain financing at a lower interest rate. If your credit score is below 670 however, budget for a higher interest rate and use the tips provided to help improve your credit score, before you begin shopping for a vehicle. If you’re ready to start shopping now, apply here!