What is a Credit Reference?

Similar to a reference for a job, a credit reference is a form of “double checking.” For many different applications, before approval the lender will ask the applicant to provide a suitable reference. Requesting a credit reference is standard practice for many different types of loans, including auto loans. This reference paints a picture of how well you can adhere to financial obligations and your credit liability.

By definition, “a credit reference is information, the name of an individual, or the name of an organization that can provide details about an individual’s past track record with credit. Credit Rating Agencies provide credit references for companies while credit bureaus provide credit references for individuals.”

Credit references are used to help lenders quantify the risk of lending to a given applicant or to determine overall creditworthiness. For example, if an applicant’s credit history indicates proper, timely payments on all outstanding obligations, a lender may judge it more likely that the applicant will make timely payments on the requested loan. Your credit references show as credit tradelines on your credit reports. What’s known as credit tradelines is also known as credit references.

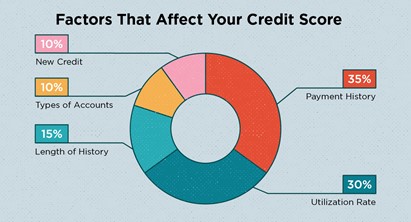

Whether the credit reference is a good one depends on if the payments have been made on time or not. The credit limit and payment history in the credit references give other potential creditors an idea on whether an individual will make payments on time or default. Credit references also determine if an individual’s credit score. A good credit score is typically a score of 700 and above but, creditors do have their own underwriting guidelines.

There is the standard credit report which you can receive through Equifax and TransUnion. Additionally, a previous lender can be used as a credit reference. The letter from the lender must detail your payment related to an original arrangement. “Sometimes, especially if you have limited credit or are seeking larger sums, both may be required.”

“Anything that documents your history within the binds of a financial arrangement can work as a credit reference. It can be a personal loan attestation from a lending party. You could use your previous car loan information to prove your creditworthiness. Alternately, rental history or mortgage records can be applied to this purpose. It is usually easier to access a credit reference from a long-term arrangement; though, provided you keep sufficient documentation you will be able to use any of the above references.”

Whether you have current debt or credit issues, our agents are here to provide information and explain your options regarding an auto loan. Have you considered giving us here at autoloans.ca a call? We afford every application we receive the same decision process, meaning that no matter how bad your credit score is, you’ll get the same degree of attention and care as everybody else.